You may know that Siemens PLM recently acquired Vistagy, whose Fibersim software has been used to design 80% of the composites currently flying in today’s aircraft.

Vistagy has been a long-term third-party partner not just to Siemens PLM, but also to Dassault Systemes. Though DS has its own composite design solution, many of its most important customers use Fibersim. To say Vistagy has been an important partner for DS would be an understatement.

My interest in Vistagy is as a microcosm of the relationship between Siemens PLM and Dassault Systemes. Let’s face it: These two companies are serious competitors. Has Siemens acquisition of Vistagy upset a tenuous détente (if it can even be called that) between these two giants of PLM?

This week at Siemens PLM Connection, I got a chance to speak with Steve Luby, the current Sr. VP of Siemens’ Specialized Engineering Software business segment, and former CEO of Vistagy. He told me that he’d always been careful in maintaining Vistagy’s relationship with DS. Since Vistagy had been a long-term partner to both DS and Siemens PLM, he got used to treading carefully. Since the Siemens acquisition, Luby explained, DS has not done anything precipitous (such as tossing Vistagy/Siemens out of their partner program.)

But that’s not surprising. Doing that would be the equivalent of mutually assured destruction. It’d be tough to explain to the biggest aerospace firms in the world that, oops, they can’t use Vistagy’s products anymore.

My guess, though, is that DS is focusing big energy on improving their composite solution (which I understand is mighty competent already), with the eye to displacing as many seats of Fibersim as they can. Yet, even in the best of all worlds, that’s going to be hard to do. I can’t imagine Boeing, for example, dropping Fibersim from the toolset used on the 787 Dreamliner—a plane that’s 50% composites by weight.

I don’t anticipate that DS is going to open their doors, and let Siemens/Vistagy have completely unfettered access to their APIs (and customers!) The current Vistagy products, including applications for composites, airframe fasteners, and automotive/aerospace seating, are probably grandfathered in. But future Specialized Engineering (i.e., Vistagy) products?

It’s a big wild-card. The new Codex of PLM Openness that both DS and Siemens recently signed would suggest that the companies are going to play nicer together than they have in the past. Yet, my reading of the Codex is that it gives an awful lot of wiggle room.

The Siemens Vistagy acquisition presents a nice public context for DS to show that they’re committed to openness. To playing (competing) nice. If my reading between the lines is right, the situation is “so far, so good.” If you’re a Vistagy customer, and you hear anything different (good or bad), I’d sure like to hear about it.

I’ve been thinking of writing a blog on this topic myself, never seem to have the time though!

A few comments:

– Every bolt on solution from a 3rd party vendor usually means another licencing cost and associated impacts (to the Design / Manf. supply chain). Some times it’s worth paying, other times it’s worth owning the functionality and sometimes the solution provider is expected to provide the right tool for the job.

– EADS/Airbus pushed DS to improve their Composites solution / offering for the A350.

– Vistagy also have a capable (scalable) assembly fastening solution (which DS don’t provide in their core product), perhaps this is another reason for the acquisition (this is a key requirement for us and some of our supply chain, which we currently address in a different way).

Open Standards are of great benefit to PLM customers (LTA and re-use make the case for this without requiring much debate). I imagine each software vendor perceives them as a threat to revealing something about their software design / implementation, when software patents don’t hold water. We’ve seen it with the changes in V5 between R8 and R18+. When you look at the move to V6 the integrated architecture seems to move even further away from truely interchangeable file formats.

There’s a certain irony in all this though – On the one hand in order to make all the systems interoperable and reduce costs for software ownership and cost of an Engineering Change, we need more tightly integrated solutions. This basically means to keep the software stack adaptable you need to embrace open standards. To counter that though, all (?) the vendors are moving towards offering complete end to end solutions (although most stop short of full ERP integration in their solution offerings). Such integrated products mean the vendor presumably can offer a more stable software stack. More reliable tools also drive service costs down.

For years SD and Siemens have played nicely with Siemens developing the Parasolid kernel upon which Solidworks is based. DS recently announced plans to offer a version of Solidworks based on an alternative kernel so will Siemens play hard and try to win back a significant portion of the mid-range CAD market during any transition. Reality is their clients will ultimately decide In a true test of brand loyalty. Of course PTC will be setting their own strategy among all this. My prediction…. Much ado about nothing!

The perception that FS was used extensively for the 787, is a lie perpetuated by Vistagy. The reality is more partners used the DS solution, or no dedicated composite design software.

Have any facts to back that up? Just because DS gives their composite solution away for nothing (which really shows the true value of it) so many companies have it in their toolset….doesnt mean they are actually using it.

Yes. I have facts and data. But none that I can share on a public forum. :-) Despite the excellent marketing by Vistagy, the two tool sets are very comparable in terms of functionality. There are pros and cons to each. The major pro for DS is that it is an integrated part of CATIA V5 VS FiberSIM as a sit-on-top add-on, with your composite data locked away in a Vistagy format.

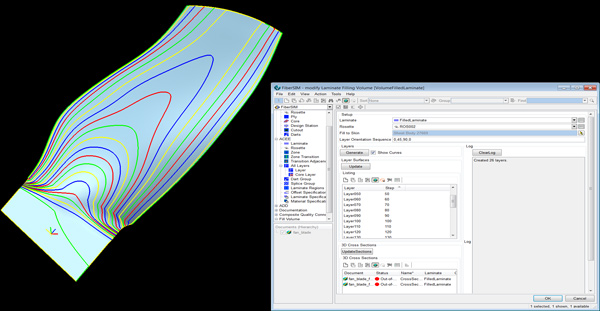

Interesting comments considering 19 suppliers for the 787 use Vistagy’s fibersim product for design and manufacturing because DS’s CPD product couldn’t do the job – I know I’ve worked with all of them. In addition, the add-on comment doesn’t seem accurate either – it has a window, yes, but so does everything that you do with DS’s CPD product. Lastly, the composite definition generated by fibersim is stored in the CAD (multiple supported) model in an xml format. That seems pretty open to me. Is it just that it is not generated in the CATIA specification tree and why is that important? Boeing used an MBD specific format that fibersim generated anyway.